One day your ceiling’s fine. The next, there’s water dripping onto your dining table. Maybe it’s after a nasty snowstorm. Or high winds. You’re staring at the stain, wondering if your insurance is going to cover the mess.

That’s a common moment for Toronto homeowners. Roof damage shows up fast, and usually when the weather’s already bad. The real question is: will your home insurance help, or are you footing the bill yourself?

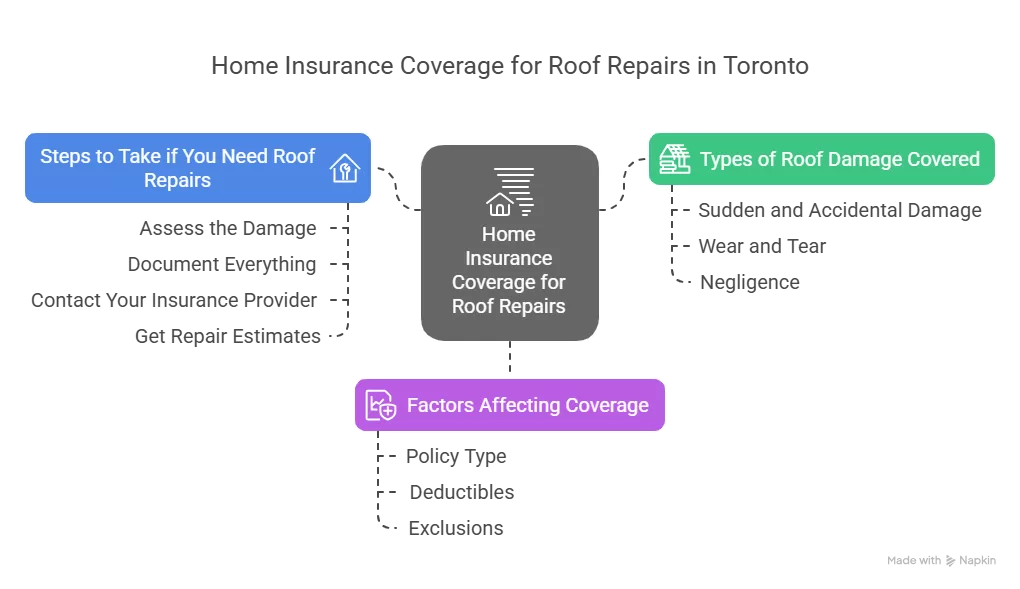

What home insurance usually covers

Sudden damage vs. wear and tear

Insurance mostly covers sudden, unexpected damage. That means if a windstorm blows a tree onto your roof, you’re likely covered. Same with things like:

- Fire

- Hail

- Lightning

- Ice damming from a sudden freeze-thaw cycle

But here’s the catch: insurance doesn’t touch problems that build up slowly. If your shingles have been falling apart for five years and now your roof’s leaking? That’s going to be your problem.

Example: A Toronto homeowner we worked with had a major ice dam after a flash freeze in January. Water leaked into their attic. The insurer paid for the roof patch and internal damage cleanup. Why? Because it happened fast and wasn’t preventable.

Types of policies people usually carry

Most Toronto homes are insured under named perils or all-risk policies. All-risk sounds better, but it also has more exclusions buried in fine print. Either way, both kinds usually include:

- Coverage for physical damage

- Limits on roof repair based on cause

- A deductible – often around $1,000 or more

Honestly, most people haven’t read their policy in full. Understandable. It’s not exactly thrilling stuff. But skipping that step leads to nasty surprises.

What’s often not covered

Maintenance issues

Insurance doesn’t cover rot, mold, or any kind of “slow leak” situation. If your flashing was loose for six months and now rain is getting in, that’s seen as lack of maintenance.

Roof age and payout limits

If your roof is over 15 or 20 years old, the insurance company might depreciate the value. That means they’ll only pay part of the repair, based on what your old roof was “worth” at the time of damage.

Some policies only offer actual cash value (ACV), not replacement cost. Big difference. With ACV, you might get $2,000 toward a $10,000 repair.

Read that part of your policy. Or ask your broker – you’re allowed to.

Common reasons for denied roof claims

Insurance companies reject claims for all kinds of reasons. Some legit. Some… a bit of a stretch.

- Improper installation – If your roof wasn’t installed to code or the contractor cut corners, they won’t cover repairs.

- Delayed response – Waiting weeks to call your insurer? That’s grounds for denial.

- “Pre-existing damage” – A classic. Even if your roof looked fine before the storm, they’ll try to say the damage was already there.

True story (names changed):

John in North York filed a wind damage claim. The adjuster came out, took photos, then said, “These shingles were already lifting.” John hadn’t noticed anything before. But because there were no ‘before’ photos, the claim was tossed.

What to do after roof damage

First steps

Act fast. That’s probably the most important part.

- Take photos immediately – Interior and exterior

- Stop more damage – Use a tarp or temporary patch

- Call your insurer and Toronto Roofer

If the roof is leaking, you don’t wait. You fix it – even temporarily. That shows you’re being responsible, which insurers like to see.

Document everything

Seriously. Everything.

- Weather reports (Was there a storm? Print it.)

- Photos, dated

- Emails or notes from contractors

- Your own notes – when did you notice the leak? What changed?

If you talk to an adjuster or roof repair contractor, write down the date and what was said. Boring? Yep. But when your claim gets questioned, you’ll want that paper trail.

How Toronto Roofer helps with insurance

We’ve seen hundreds of roof claims get approved — and dozens more denied. Here’s how we help homeowners in Toronto:

- Free inspections – We look at the damage fast

- Detailed written assessments – Insurers want proof

- Photos and timelines – We give you documentation

- Help with adjusters – We don’t argue, but we explain things clearly

We don’t promise approvals. That’s out of our hands. But we do make sure you’re not showing up to that fight empty-handed.

Tips to stay covered in the future

- Get your roof inspected once a year

- Clean your gutters before winter

- Check attic ventilation – that helps prevent ice dams

- Fix small leaks or shingle issues fast

- Ask your insurance agent to walk you through your roof coverage

Insurance isn’t built to be generous. You’ve got to play by the rules. That means being proactive.

FAQs

Does insurance pay for a full roof replacement in Toronto?

Only if the damage is sudden and extensive. Partial repairs are more common. Replacement is possible but not guaranteed.

Is wind damage to a roof covered by insurance?

Yes, if it’s sudden and clearly caused by high winds. You’ll need photo evidence and weather data to back it up.

How do I prove my roof damage was sudden?

Take photos immediately. Use weather records. Get a contractor like Toronto Roofer to confirm it wasn’t pre-existing.

Will my insurance go up if I make a roof claim?

Sometimes. It depends on your insurer and whether it’s your first claim. Always ask them directly.

What if I have an old roof in good condition?

You’ll get less money if it’s old. Insurers will factor in depreciation. Even if it’s well-maintained.

Are flat roofs treated differently by insurers?

Sometimes. Flat roofs are seen as higher risk for leaks, especially in winter. Coverage may be more limited or cost more.

Does insurance cover leaking roofs in winter?

If the leak comes from a sudden event like an ice dam or storm, yes. If it’s been building over time, no.

Need Help with Roof Repairs or Insurance Claims?

Don’t let a denied claim or leaking roof turn into a disaster. Toronto Roofer offers fast inspections, expert documentation, and emergency roof repairs across the GTA.

Call us today at (647) 847-8826 or visit toronto-roofer.com to book your inspection.

We don’t just fix roofs. We help you fight for your coverage – with receipts.